About Management 360 - Accounting Software

How Management 360 Works

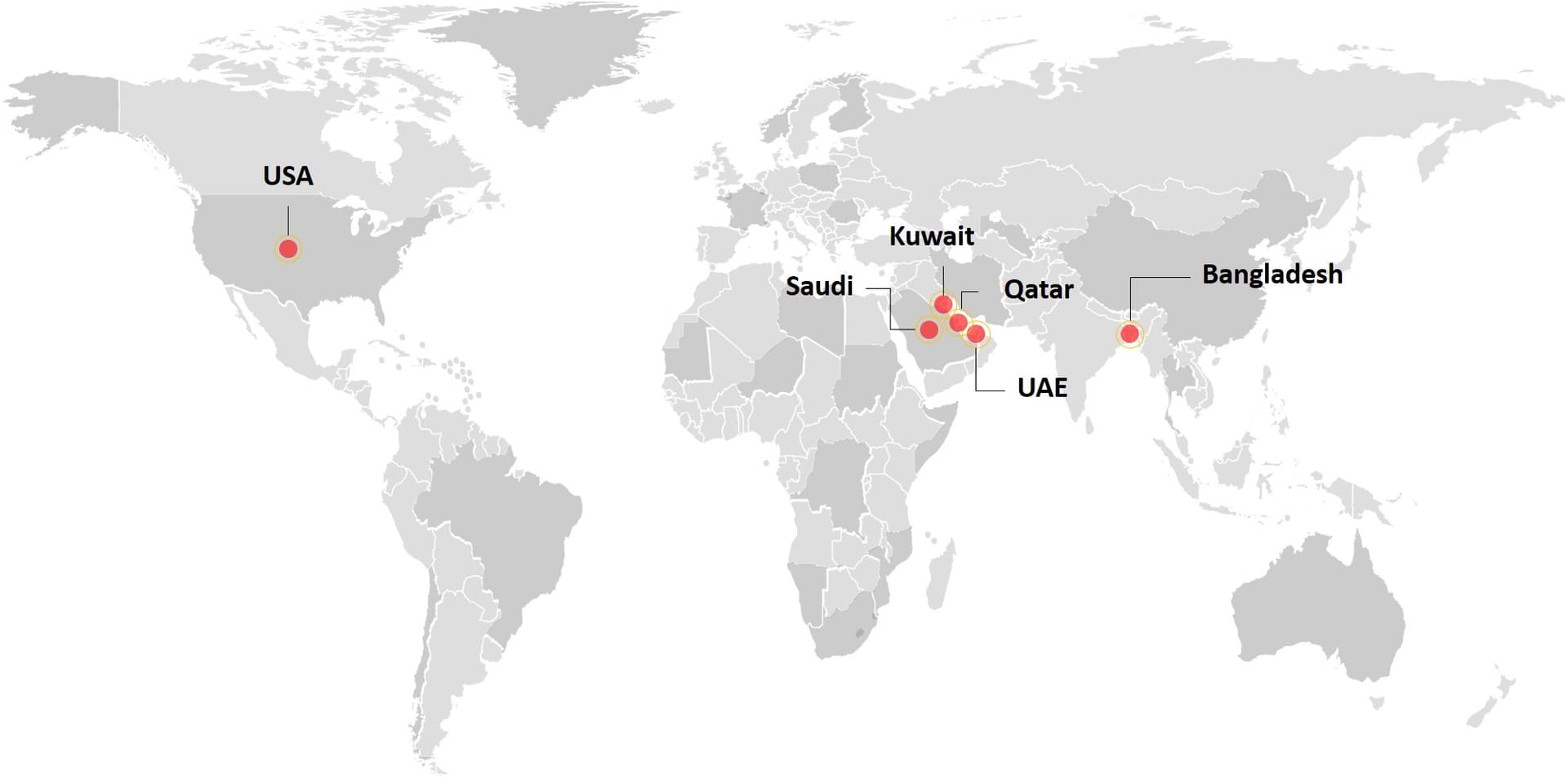

Clients who have trusted Management 360

Why Management 360

Compliance

Integrated Withholding Tax & VAT

Management 360 calculates withholding tax and vat amount automatically when making payments to vendors. You can send out TDS & VDS certificates and challans to vendors with just a click of a button.

Storage

Centralised Document Management

There’s no need to save files across different drives. You can keep all of your files, such as contracts, agreements, challans and certificates safe in one place.

Reporting

Financial and Compliance Reporting

Not only Management 360 generates Financial Statement (e.g. Profit & Loss Statement, Balance Sheet and Trial Balance), you can also generate and download various compliance reports.

Management 360 Modules

Products & Services module

Manage all your products & services and categorise them according to their nature.

Banking module

Add bank accounts, upload & manage bank statements and perform bank reconciliations.

Contacts module

Add vendors, suppliers, employees & shareholders and manage their TIN, BIN & Proof of Return Submission.

Sales and Invoicing

Create, print & send invoices, issue Mushak 6.3 and record payment receipts.

Purchase and Expenses

Record bills & expenses, track Mushak 6.3, deduct tax, deduct vat and record payments.

Document Management

Upload, download, share and manage all you business documents in a single platform.

Accounting module

Record journal entries, download general ledgers and generate financial statements.

Withholding Tax module

Track withholding tax, manage trasury challans, generate withholding return and certificates.

Withholding VAT module

Track withholding vat, manage trasury challans, generate monthly returns and VDS certificates.

Have questions?

If you have any inquiry or request that require a more personal response, please feel free to leave a message or call us.